Insights

What are Asset-Backed Securities (ABS)?

Home / Insights

An asset-backed security (ABS) is a type of investment that’s supported by a group of loans or other types of credit, like lease payments. As the borrowers make their regular payments, that money is passed on to investors as income, with the full amount repaid when the investment reaches the end of its term. These types of assets are essentially agreements that generate regular payments to investors. Asset-backed securities (ABS) allow financial institutions to turn assets that aren’t easily sold, like loans or leases, into tradable investments that can be bought and sold more easily.

The UK is the largest player in the European securitisation market. At the end of the fourth quarter (2015) the total market of outstanding securitisations in Europe was £865 billion (source).

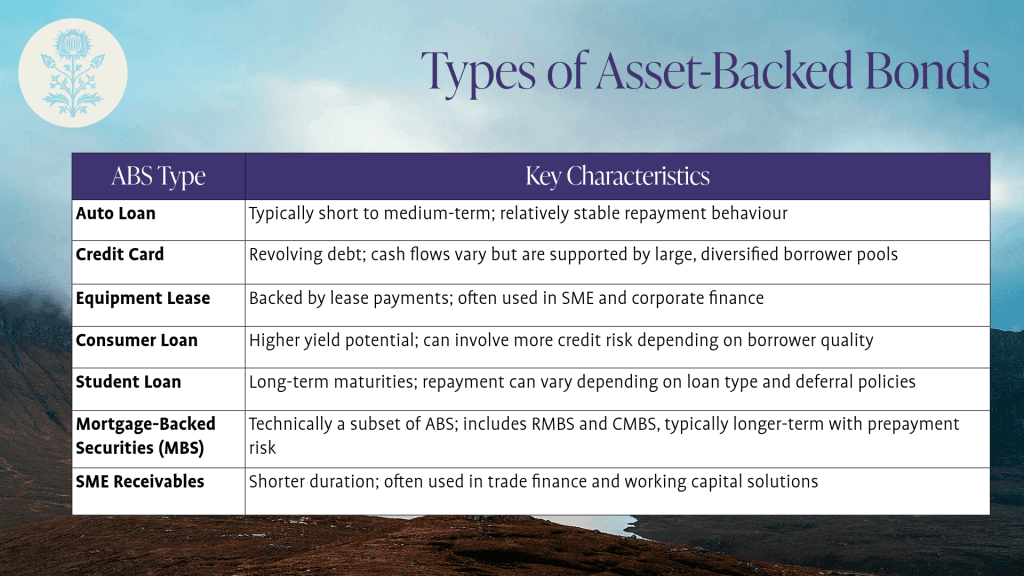

Types of ABS

How ABS Differ From Traditional Bonds

While both asset-backed securities and traditional bonds offer regular income and return of capital at maturity, they are structured differently and carry distinct types of risk.

Traditional bonds are typically issued by governments or corporations and are backed by the issuer’s promise to repay. In other words, your investment depends on the financial health of the issuing entity. If the issuer runs into trouble, the bond’s value – and the likelihood of full repayment – can be affected.

ABS, on the other hand, are backed by specific pools of underlying assets, such as car loans, mortgages, or credit card receivables. Instead of relying solely on an issuer’s creditworthiness, ABS performance is tied to the cash flow generated by those individual loans. This structure can offer a layer of protection, as the investment is supported by real assets and diversified across many borrowers.

Another key difference is how the risk is managed. ABS are often divided into different layers, or “tranches,” each with varying levels of risk and return. This allows investors to choose a risk profile that suits their needs – something traditional bonds don’t typically offer.

In short, ABS can provide more flexibility and asset-level transparency, making them an attractive option for those looking to diversify away from traditional fixed income.

Below shows a comparison table that highlights the key differences between Asset-Backed Securities (ABS) and Traditional Bonds:

| Feature | Asset-Backed Bonds/ Securities (ABS) | Traditional Bonds |

|---|---|---|

| Backing | Pool of underlying assets (e.g. loans, leases, receivables) | Issuer’s credit and promise to repay |

| Cash Flow Source | Payments from individual borrowers in the asset pool | Payments made directly by the issuing entity |

| Risk Diversification | Spread across many underlying loans | Concentrated in a single issuer |

| Structure | Often divided into tranches with varying risk/return levels | Generally uniform structure across bondholders |

| Transparency | Based on underlying asset performance | Based on the issuer’s financial health |

| Liquidity | Can be less liquid, especially in private markets | Often more liquid, especially for government and blue-chip bonds |

| Typical Issuers | Financial institutions, lenders, and structured finance vehicles | Governments, corporations, and municipalities |

Risks and Considerations of ABS

While asset-backed securities (ABS) offer notable advantages, it’s essential to understand the associated risks to make informed investment decisions:

- Credit Risk

The performance of ABS is directly linked to the creditworthiness of the underlying assets. If many borrowers default on their obligations, the cash flows to investors may be affected. Although structures like overcollateralization and tranching provide buffers, they cannot entirely eliminate credit risk.

- Liquidity Risk

ABS can be less liquid than traditional government or corporate bonds, especially in private markets or during periods of financial stress. This means it might take longer to sell the investment if needed, or prices may be more volatile in thinly traded markets.

- Structural Complexity

The intricate structures of ABS, including various tranches and payment waterfalls, can make them challenging to evaluate. Investors must thoroughly understand these mechanisms to assess potential returns and risks accurately.

- Interest Rate Sensitivity

ABS are susceptible to interest rate fluctuations. Rising interest rates can reduce the value of fixed-income instruments and influence prepayment behaviours in the underlying assets, affecting investors’ timing and amount of cash flows.

When to Consider Asset-Backed Securities

Asset-backed securities (ABS) can be a valuable addition to a portfolio in a variety of market conditions, but they are particularly relevant when:

- Markets are volatile: ABS offer income based on predictable cash flows rather than market sentiment, helping to cushion portfolios during turbulent periods.

- Traditional fixed income yields are low or under pressure: ABS can provide enhanced risk-adjusted returns compared to government or corporate bonds.

- You need diversification: Because ABS are backed by a wide range of asset types – from vehicle loans to business receivables – they can reduce reliance on equity and bond markets.

- Income stability is a priority: ABS are structured to generate regular, steady income, which can be particularly attractive in retirement-focused or income-driven strategies.

Investors looking to balance return potential with a disciplined approach to risk may find ABS a compelling option, especially when supported by experienced managers with a strong focus on credit quality and structure, like Clann Investments.